The Upsides and Downsides of Retiring in an HOA Community

You've finally retired, moved into a peaceful community, and suddenly you're paying a monthly fee to people who dictate how tall your grass can be. Welcome to HOA life! For retirees, it can be either a blessing or a pain. We’ve compiled some pros and cons you should know before committing.

Pro #1: Low-Maintenance Living

Tired of mowing your lawn or shoveling snow in the colder months? Most HOA communities help you with those chores. Imagine sitting back and drinking iced tea while someone else battles with the leaf blower.

Pro #2: Tons of Amenities

You get access to pools, gyms, tennis courts, and sometimes, golf courses too. It’s a resort lifestyle without the resort fees. The catch? You’re pretty much paying for it through fees, so you better be ready to use that pickleball court you said you would try out.

Pro #3: Built-In Social Life

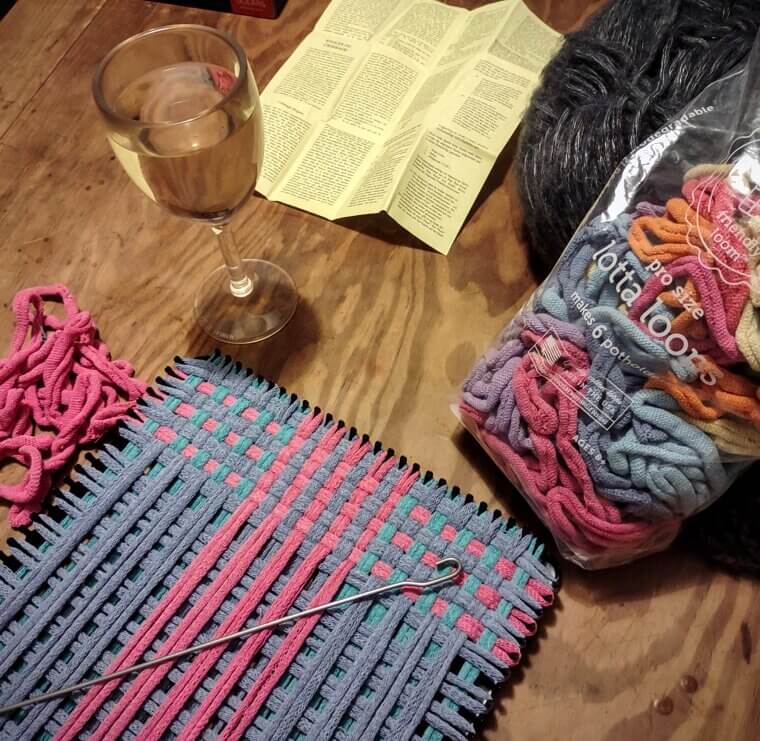

With book clubs, craft nights, and pickleball leagues, your calendar may be busier than it was before you retired. If you are a social person, you’ll love it. If you're an introvert, however, maybe you should prepare for a couple of awkward invitations you’ll want to politely decline.

Pro #4: Property Values Stay Higher

HOAs enforce rules that keep neighborhoods neat and tidy. No rusty cars on the lawn, no hot-pink houses next door. That means your home value is protected. It also means you might not be able to plant that flamingo army you secretly dreamed of.

Pro #5: Less Stress About Security

Many HOA communities have gates, cameras, or even private security patrols. It’s like having neighborhood watch on steroids. Just know, those gates won’t prevent nosy neighbors from asking about your lawn gnomes.

Pro #6: Curb Appeal Is Consistent

HOA regulations ensure that every yard is maintained, every home is neat, and the entire neighborhood looks like a glossy magazine spread. It is the type of consistency that makes pulling into your driveway that much more satisfying.

Pro #7: Built-In Maintenance Fund

Instead of worrying when the clubhouse roof leaks or there is a need to resurface the pool, the HOA usually has a fund for that. Big repairs aren't just your responsibility. It's like a retirement “peace of mind” potluck, everyone contributes, and nobody is left with the bill.

Con #1: Less Control Over Your Property

It’s your house, but not completely. HOAs can restrict you from using certain paint colors, types of fencing, and landscaping. They can even tell you how many cars can park outside your home. If you like having total control, you may not enjoy these restrictions.

Con #2: Rules, Rules, Rules

Want to build a backyard deck, park an RV, or put up Christmas lights in July? The HOA will say no. Some rules seem reasonable, and others seem completely absurd. If you dislike the idea of someone telling you what to do, this will drive you insane.

Con #3: Personality Politics

Every HOA has that one neighbor who takes their board duties way too seriously. Suddenly, you’re in turf wars over mailbox colors or trash-can placement. Retirement wasn’t supposed to come with middle school drama, but sometimes, it feels that way.

Con #4: Surprise Fees

Monthly fees and dues are fine until you get a “special assessment.” That’s HOA’s way of saying, “Surprise! We have to fix the pool, and you’re paying for it.” Surprise charges can hurt, particularly if that charge is coming out of your retirement budget.

Con #5: Creeping Dues

What starts as $150 a month can turn into $300, $400, or more. Retirement income does not always expand to accommodate these bills. And, once you join, it can be hard to leave; you can’t just opt out like a gym membership.

Con #6: Cookie-Cutter Living

HOAs love uniformity, which makes every street look a bit too boring. Great if you like order, but not so fun if you want personality. If you want your home to stand out, the “everything matches” vibe can feel stifling.

Con #7: Legal Headaches

Getting into an argument with your HOA can turn into a much worse situation, even ending up in court. The last thing anyone wants to do is spend their retirement money on a legal battle over a fence height or a shed size, but it does happen more often than you'd think.

Con #8: No Rentals

Are you thinking of renting out your place for some extra retirement income? Many HOAs have limits or outright restrictions on rentals. The rule is great for neighborhood stability, but not if you were planning on using Airbnb money to fund your vacations.