Boomers Have Said Goodbye to These Bills in Their Retirement

Are you on the brink of retirement, and are wondering which expenses you can cut to save your hard-earned savings? Well, there are more and more money cuts that Boomers are doing. So, continue reading to uncover 7 bills retired Boomers are no longer paying!

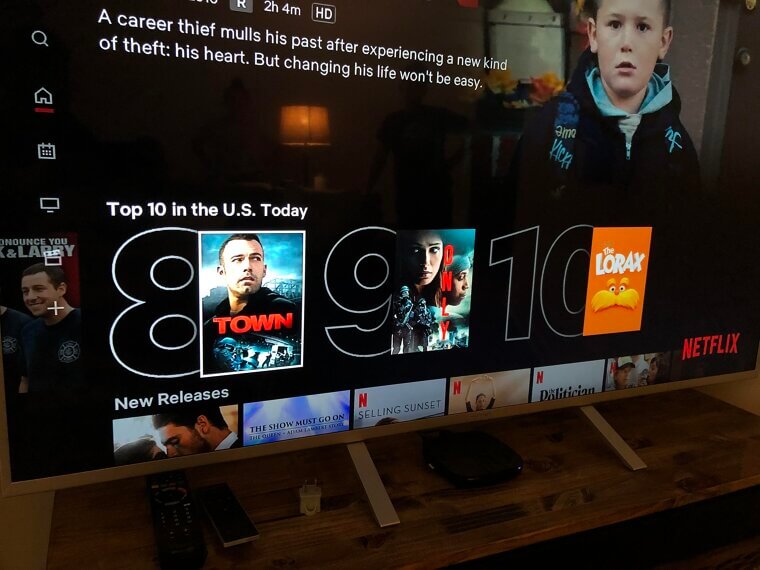

Streaming Services

In retirement, streaming services frequently lose their appeal, which was once crucial for keeping up with popular shows. Many Boomers are canceling subscriptions they hardly use, saving a good amount of money in the process, as they have more time for activities and less interest in binge-watching.

Landline Mobile

Finally, the reliable landline has been surpassed. Many retirees are choosing a single cell plan that suits their lifestyle rather than two phone configurations. It's a straightforward transition that eliminates expenses, clutter, and those enigmatic monthly fees!

Expensive Gym Memberships

Expensive fitness centers with smoothie bars and eucalyptus towels? Not exactly a top priority for retirement. Boomers are choosing to keep active without the high monthly cost or the need to "upgrade" their fitness attire by switching from expensive memberships to at-home workouts, walking clubs, or community centers.

Data Plans

Retirees frequently reduce their cellphone data plans since they’re no longer bound by work emails. Downsizing to a basic plan makes perfect sense since you already have Wi-Fi at home and have fewer needs when you're on the move.

Costly Cable Packages

At last, many Boomers are cutting the cord, choosing simpler, less expensive alternatives to bulky cable bundles. The outcome is the same whether it's free-to-air television or a simplified streaming setup: less expense, greater control.

Storage Units

That spare apartment with the mystery boxes and misplaced furniture? It’s being fired. Decluttering, downsizing, and understanding they don't have to pay a monthly fee to store items they haven't seen or missed in years are all trends among retirees.

Second Car Expenses

One car usually suffices when there are fewer commutes and a slower pace. In order to save on insurance, maintenance, and gasoline expenses, retirees are selling their second cars. It's a sensible decision that makes life easier, frees up more space in the driveway, and saves money!