Expensive States

Retiring in an expensive state might sound like a bad idea, but plenty of retirees still choose places where the cost of living is high. Why? Lifestyle, healthcare, and natural beauty are all reasons given by those who chose a pricey place. Plus, sometimes people simply have family links to the place they choose to spend their golden years in. Let’s take a look at the 15 most expensive states and see what recommends them.

Hawaii

Hawaii is beautiful but it’s also incredibly expensive. Groceries, housing, and utilities all come at a high cost thanks to its remote location, and let’s not forget that overtourism is a massive problem as well. Still, retirees can’t resist the islands’ sunshine and beautiful beaches. Many people dream all their lives of retiring to Hawaii and they’re not about to let a high price tag get in the way.

California

California isn’t cheap, especially when it comes to housing and taxes, but it has undeniable appeal. Hollywood is there, after all, with all the glitz and glamor that promises – or if you want something slower, there’s wine country. And the weather is a huge draw. No harsh winters to worry about, and lots of sun!

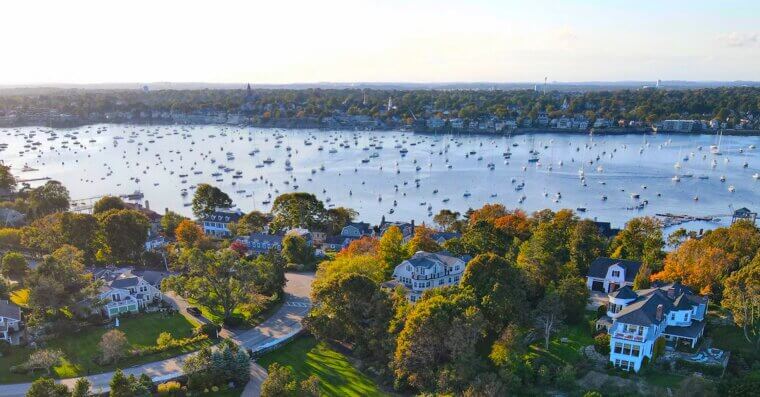

Massachusetts

Yes, Massachusetts can eat into your retirement savings quickly with high housing and healthcare costs, but many people believe it makes up for it in quality. Retirees are drawn to world-class hospitals, nice museums packed full of history, and charming coastal towns.

New York

New York, New York, so good they named it twice. It’s not a very cheap place, especially for retirees, but people love it nonetheless. Older people love having access to everything - Broadway shows, museums, great restaurants, and (most importantly) world-class healthcare.

Connecticut

Connecticut’s combination of high property prices, taxes, and living costs makes it expensive for retirees. And yet there’s so much to love about it… scenic New England charm, proximity to New York City and Boston, and what’s generally considered to be top-notch healthcare.

New Jersey

High taxes and pricey housing make some turn their noses up at New Jersey, but retirees stay because of its location and amenities. Beaches, cultural attractions, and access to both New York City and Philadelphia make it appealing, regardless of the cost.

Washington

Washington State has high housing prices and overall living costs, especially near Seattle. Still, retirees love the natural beauty - mountains, coastlines, and endless gorgeous greenery. Oh, and there’s no state income tax, which softens the financial blow quite a bit.

Maryland

Maryland is pricey, particularly for housing and taxes, but retirees value its climate and amenities. And the fact that there’s great access to healthcare doesn’t hurt either. Basically, if you’re already rich and you love the coast, Maryland is probably the place for you.

Oregon

Living in Oregon unfortunately isn’t cheap, thanks to rising housing costs and overall cost of living expenses, but it has unique things about it that draw people in. Retirees especially love the mix of natural beauty - mountains, forests, and coastline - plus Portland’s famously quirky culture.

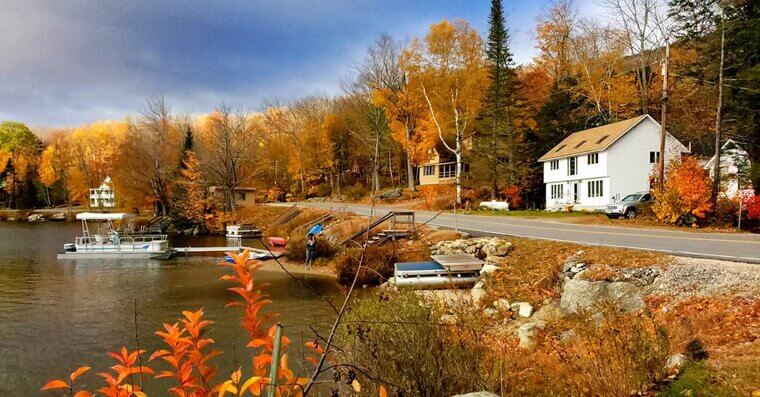

Vermont

Vermont’s small-town charm and natural beauty come at a steep price. The cost of living and taxes can add up quickly, not to mention the cost of healthcare. Still, retirees who value peace, nature, and a close-knit community often choose Vermont, and few complaints come from the area.

Colorado

Colorado’s booming popularity has made housing and living expenses skyrocket. Yet retirees are drawn to its beautiful mountains and mild climate, and they’re willing to put up with a little bit of cost for the sake of all the state has to offer – which includes good healthcare and excellent hospitals.

Alaska

Alaska makes the expensive list because of high costs for groceries, utilities, and healthcare. The state has always been an expensive one, unfortunately. But for adventurous retirees, it’s still a dream come true - untouched snowy landscapes, stunning wildlife, and endless outdoor opportunities. Just don’t go if you don’t like the cold!

Maine

Maine isn’t cheap, especially with rising housing costs and heating expenses, but retirees love it for its peace and quiet and access to good healthcare. It’s another place you really have to be rich to retire to, but maybe you already are and the world is your oyster.

Rhode Island

The smallest state in America comes with big living costs. Rhode Island’s housing and taxes are high, but the calm coastal lifestyle keeps retirees flocking to the place. If you want a relaxing retirement with a boat, Rhode Island could be just what you’re looking for.

New Hampshire

New Hampshire’s housing costs and property taxes make it one of the pricier retirement states. Still, retirees are drawn to its considerable tax advantages - no state income tax or sales tax. Add in beautiful landscapes and you’ve got yourself a winner.