Simple, Smart Ways for Retirees to Live the Life Without Breaking the Bank

Retirement should be easy, not stressful. Your money can go further without giving up comfort. All it takes is a few small changes that make a difference. Get ready to stretch your savings and keep your lifestyle as we look at 35 ways to make your money last.

Home-Cooked Meals for the Win

Cooking at home saves a ton of money. Eating out is great, but the costs add up fast. When you cook at home, you control portions, flavors, and ingredients. It also tastes better. Find a few great recipes, choose your own ingredients, and save money.

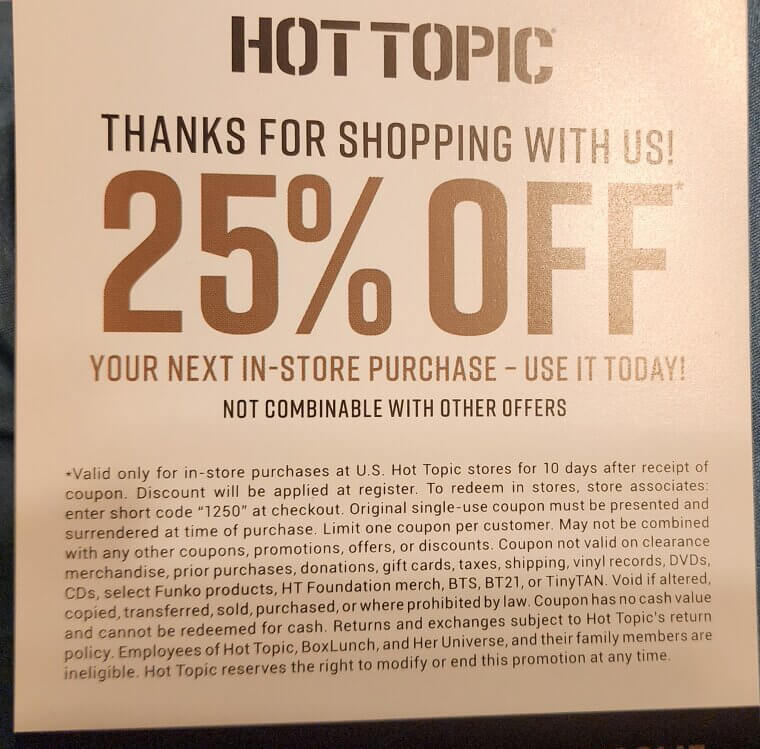

Sales Are Your Best Friend

Why pay full price when you don’t have to? Sales, coupons, and store specials stretch your budget without you giving up anything. Grab deals, stock up, and watch your grocery bill shrink. Every dollar you save adds up in the long run.

Store Brand Wins

Store brands taste and work just like the fancy name brands. The only real difference is the label. Try a few items and you’ll see that they’re the same. You’ll save money without losing quality. No one will know the difference when they come over for dinner.

Smaller Space, Bigger Savings

Downsizing feels scary, but it makes life easier. A smaller home means less cleaning, lower bills, and more money in your pocket. Think of it as trading in “stuff” for peace of mind - and maybe even a little extra cash from selling unwanted goods. Garage sale, anyone?

Extra Space, Extra Cash

If you have an extra room or basement that’s not in use, why not let it work for you? Renting it out brings in steady money. You don’t lose comfort. In fact, you gain financial breathing room. Your house starts paying you back. Not a bad deal, right?

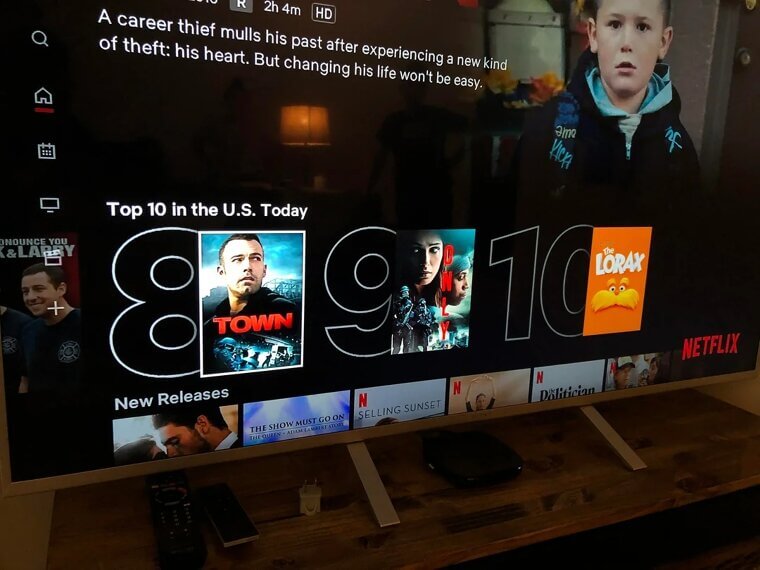

Bye-Bye Cable

Cable bills are sky-high these days. Switching to streaming gives you all the shows and movies you want for way less. Most streaming platforms are easy to use and let you cancel anytime. Pick a couple you like and save hundreds a year without missing anything.

Senior Discounts Rule

Never be shy about asking for senior discounts. Restaurants, stores, travel companies, and even movie theaters offer them. A simple question can save you a nice chunk of change. Think of it as one of the perks you’ve earned and enjoy the benefits.

Off-Peak Travels

Traveling off-peak, when the crowds are gone, saves a fortune. Off-peak flights, hotels, and tours cost less, and you often get better service. Plus, fewer people mean a calmer trip. You’ll enjoy the same sights and experience for much less.

Take The Bus

Owning a car is pricey. From gas and insurance to repairs, the list goes on. Public transport cuts those costs entirely and still gets you where you need to go. Many cities even offer senior passes for extra savings. Ride the bus or train and free up cash.

Ride-Sharing Made Easy

If public transportation isn’t your thing, ride-sharing with friends or neighbors can help cut gas and parking costs in half. And, it’s more fun with company. Even short trips to the store add up over time. You get the bonus of catching up with a friend on the way.

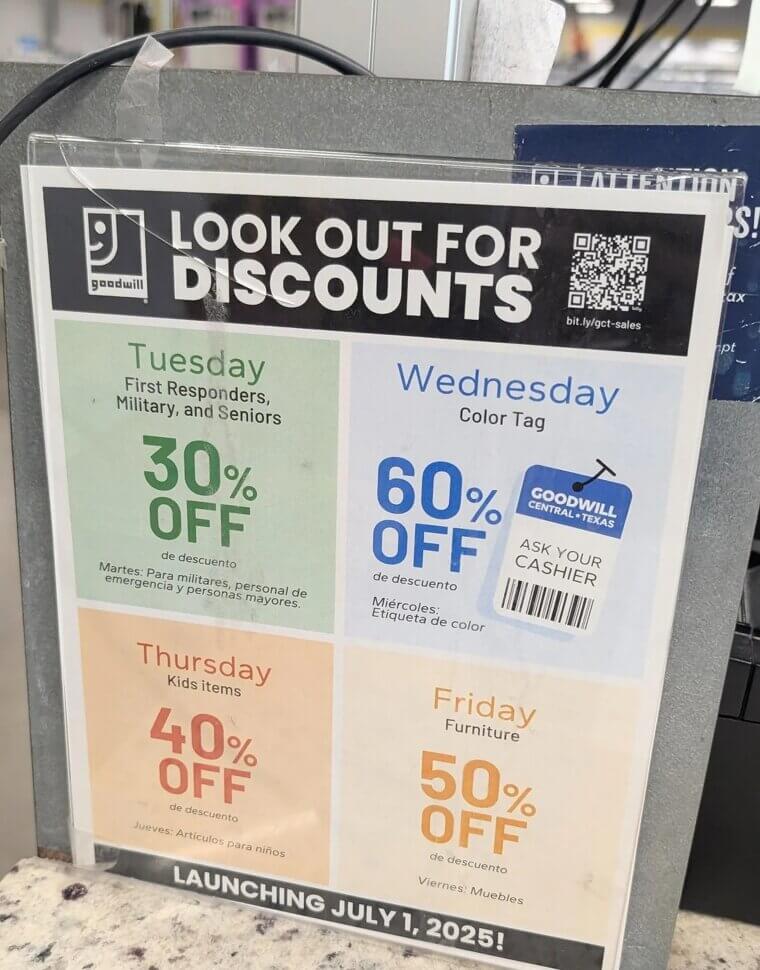

Secondhand Treasures

There’s really no need to buy something brand new when you can find amazing deals secondhand. Thrift stores, consignment stores, and online marketplaces are full of gently used items looking for a new home. You snag great quality for a fraction of the cost.

Free Fun in Your Community

Entertainment doesn’t have to be expensive. There are always free concerts, festivals, and activities to enjoy. Local community centers often have events that are free, too. Meet new people, have fun, and keep your money in your wallet where it belongs.

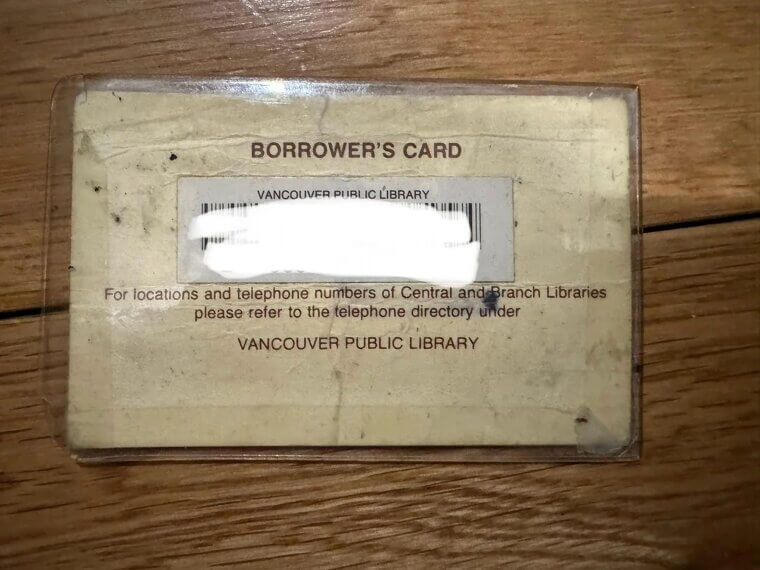

Library Goldmine

Libraries aren’t just for books anymore. You can now lend movies, music, audiobooks, and even games from your local library. Some even offer free classes and workshops too. A library card can save you hundreds of dollars a year and provide endless entertainment.

Grow Your Own Goodies

A small garden is a great idea. Why? Because it gives you fresh food right outside your door, and also something to do. Even a few pots of herbs or tomatoes make a difference. Nothing beats the taste of food you grew yourself.

Trade, Don’t Pay

Sometimes, you don’t need money - you just need friends or like-minded acquaintances to swap services like pet-sitting, dog-walking, house-watching, or even handyman help. You get what you need without spending a dime. It’s a win-win.

Power-Smart Living

Energy-efficient appliances might cost more upfront, but they save you big money over time. They use less electricity and water, so your bills shrink. Pair that with a few simple habits like shorter showers and unplugging unused gadgets, and your home runs cheaper.

Switch It Off

Little changes in how you use electricity can save a lot - things like turning off lights when you leave a room, or unplugging any phone chargers when they’re not in use. You’ll really notice the difference when the bill comes.

Loyalty Pays

Stores love loyal customers and often reward them. Sign up for loyalty programs at your favorite stores to get discounts, freebies, and special deals. Now stack those rewards with sales and coupons, and you’re getting free savings. It’s like getting paid for what you already need.

Plan Before You Cook

Meal planning stops waste and saves money. Plan what you’ll eat for the next week, then shop only for those items. You’ll throw away less food and spend less money. Plus, it makes dinnertime easy because you already know what’s on the menu.

Bulk Up on Essentials

Buying in bulk feels like a lot upfront, but the long-term savings are worth it. Stock up on things you always use, like toilet paper, rice, or soap. You’ll shop less often and pay way less per item. Just make sure you have room to store it all.

Market Closing Magic

Farmers’ markets are amazing for fresh food. If you go near closing time, vendors often drop prices just to clear out stock. You still get great produce, but you pay a lot less. It’s a little secret that saves you a nice chunk of money.

Say “Adios” to Subscriptions

Subscriptions sneak up on you. Magazines, apps - you name it. Check your bank statements often and cancel anything you don’t use often. You’ll be surprised at just how much you’re paying for things you forgot about. You’ll have more money for things you actually enjoy.

Free Fitness

Gym memberships are expensive. Staying healthy doesn’t have to cost a thing. Walk in the park, do simple stretches at home, or try free workout videos online. It keeps your body moving and your wallet full. Exercise doesn’t need fancy equipment to be effective.

Borrow, Don’t Buy

Need a tool for a one-time job? Don’t rush to buy it. Borrow from a friend or neighbor. You save money and precious space in your garage. Sharing makes life easier - and it keeps your shelves from filling up with even more stuff.

Tame Your Debt

High-interest debt drains your savings fast. Look into refinancing or consolidating your debt to lower your payments. Less debt means more financial freedom to enjoy retirement the way you want. Get control of your bills, and the savings go right back into your pocket.

Cash-Back Bonus

Those cash-back rewards on your credit cards add up. Pay your balance in full each month, and it’s basically free money. Use those rewards for groceries, travel, or fun extras. Just don’t overspend on chasing points. Let the points work for you, not the other way around.

Staycation Vibes

Vacations don’t always have to mean expensive flights and hotels. A staycation lets you enjoy your own city or nearby spots. Try new restaurants, explore parks, or visit a few local attractions. Sometimes the best getaway is right outside your door.

Free Learning Fun

Want to learn something new? A new language or hobby? Skip pricey classes and look online for free lessons in everything from cooking to painting and history. It’s fun, keeps your brain sharp, and doesn’t cost a cent. Retirement is the perfect time to pick up a hobby.

Reuse With Style

Before tossing something out, ask yourself if it can be reused. Old jars become storage containers, worn-out shirts become cleaning rags, and furniture can be upcycled with a little paint. It feels good to save money and waste less.

DIY Fix-It-Skills

Hiring someone for every little repair gets pricey fast. Learning a few simple DIY fixes saves you a lot of money. Things like changing lightbulbs, tightening screws, or even patching small holes in the wall are easier than you think. YouTube is full of free tutorials.

The Power of a Budget

Budgets might sound boring, but they’re powerful. Tracking what comes in and goes out shows where you can save without giving up comfort. It’s not about being strict - it’s about being smart with what you have. Once you see where your money goes, you can make it stretch further.

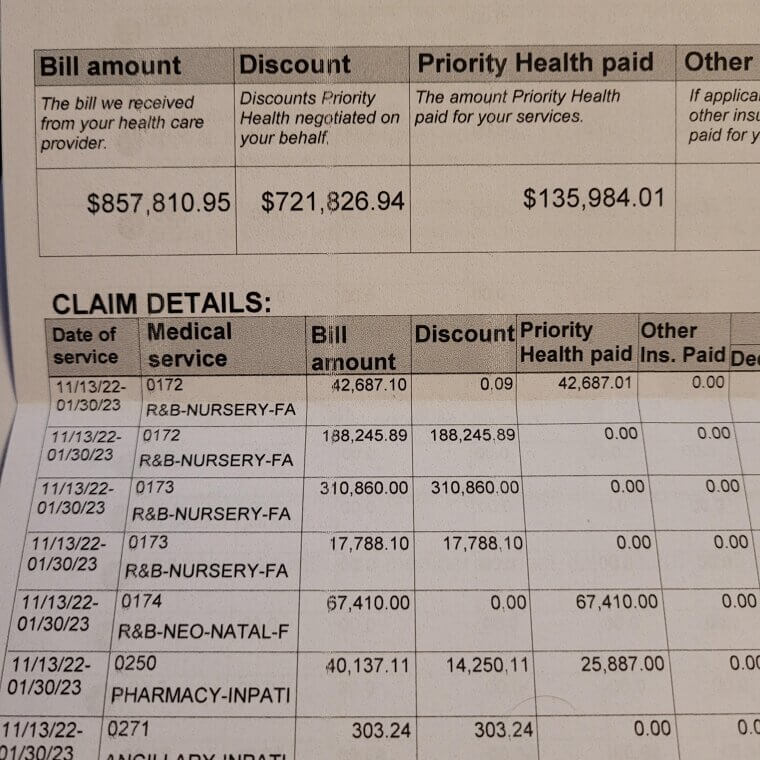

Insurance Check-Up

Insurance companies love raising their rates. Shop around every year or two. Switching providers can save you hundreds of dollars. Even calling your current one and asking for a better deal works. It’s worth the effort when you’re saving money.

Wardrobes That Work

You don’t need a closet full of clothes to look stylish. Focus on a few staple pieces you can mix and match. A few good basics go a long way. This saves money, cuts clutter, and makes getting dressed simple. Looking good doesn’t have to cost a fortune.

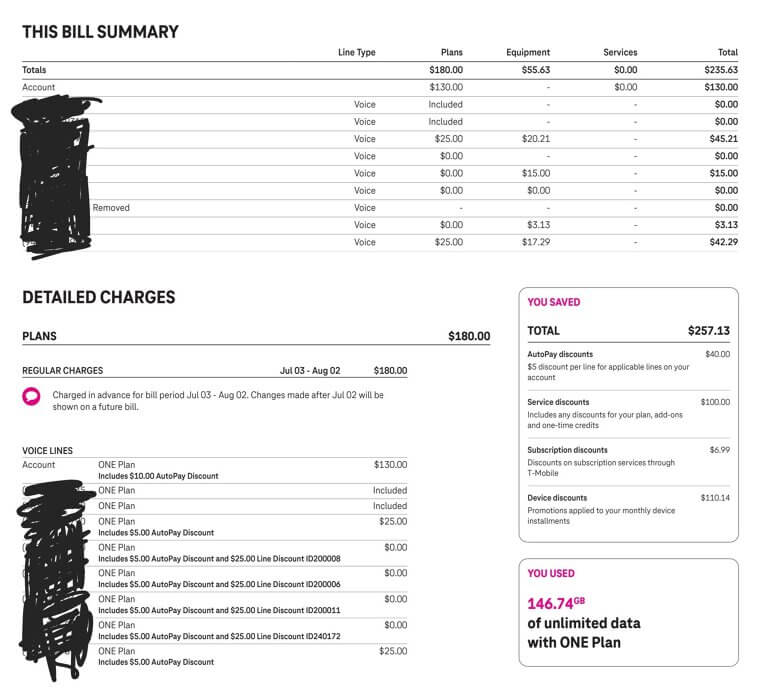

Ask and Save

Many bills are negotiable - yes, even your internet and phone bill. Call and ask for discounts or mention a competitor’s deal. Companies will often lower your rate just to keep you. A five-minute phone call can save you serious money.

Memories Over Things

Stuff piles up, but memories last forever. Spending on experiences instead of more “things” can make you happier while still keeping costs down. Comfort isn’t about clutter - it’s about living well and within your means. Choose simple things like picnics with friends and save your money.