Better Plan Ahead for the Later Years

Retirement is often seen as the reward for decades of hard work, but many retirees admit there are expenses they wish they had planned for more carefully. From unexpected healthcare costs to once-in-a-lifetime experiences, hindsight offers valuable lessons about financial priorities. Here are some of the things retirees say they wish they had saved more money for.

When people look back on their retirement years, many realize there were expenses they didn’t fully anticipate. While day-to-day living may be manageable, unexpected costs and missed opportunities often stand out the most. From healthcare to family moments to once-in-a-lifetime adventures, here are some of the things retirees wish they had saved more money for.

Unexpected Healthcare Costs in Retirement

Healthcare expenses often catch retirees off guard. Many find themselves facing substantial medical bills they didn't anticipate. Routine check-ups, unexpected hospital visits, and rising medication costs can significantly impact financial stability. Planning for these expenses is crucial, as healthcare can become one of the largest budget items. By saving more beforehand, retirees can better manage these unforeseen costs and enjoy a more secure and comfortable retirement.

It's wise to prioritize saving for healthcare in retirement. Preparing for future medical needs ensures greater peace of mind and financial security.

Essential Mobility Aids for Retirement

Many retirees find themselves needing mobility aids to maintain their independence and quality of life. Investing in reliable equipment, like wheelchairs, can significantly impact daily comfort and accessibility. These aids often come with unexpected costs, prompting retirees to wish they had allocated more savings for them. Ensuring mobility and ease of movement becomes crucial, affecting not only physical well-being but also social engagement and mental health. Proper planning can alleviate future financial stress.

Reflecting on these needs, early financial planning becomes essential. Allocating funds for such necessities ensures a smoother retirement, where mobility challenges do not hinder freedom or peace of mind.

Essential Funds for Long-term Care

Many retirees find themselves unprepared for the costs associated with long-term care. This often-overlooked expense can quickly become a significant financial burden. Assistance with daily activities, whether at home or in a facility, requires careful financial planning. Retirees frequently wish they had allocated more savings specifically for this purpose. Underestimating these costs can lead to stress and financial strain, overshadowing what should be a peaceful time in life.

Planning for Future Care Needs

Planning for Mobility and Comfort

As we age, maintaining mobility becomes crucial for ensuring a high quality of life. Many retirees find themselves wishing they had set aside more funds for mobility aids, such as canes and walkers, to preserve their independence. It’s not just about getting from point A to B, but also about staying active and engaged in daily life. Investing in comfortable, accessible living environments can greatly enhance retirement years. Planning ahead can make these transitions smoother.

Prioritizing funds for mobility aids ensures independence and comfort. Investing in accessible home modifications can significantly improve retirees' daily lives and overall satisfaction. Thoughtful planning provides peace of mind.

Health Maintenance Expenses During Retirement

Many retirees find themselves surprised by the rising costs of healthcare. The image highlights a common scenario where healthcare maintenance expenses, such as prescriptions or supplements, can become a significant financial burden. Planning for these unforeseen costs is crucial, as prices often increase over time. Without proper savings, retirees may struggle to cover these essential expenses. It’s a reminder of the importance of budgeting for health-related costs in retirement.

Consider allocating funds specifically for medical emergencies to ensure peace of mind. This proactive approach can help manage unexpected healthcare expenses, reducing stress during retirement.

Financial Planning for Peace of Mind

Meeting with financial advisors is something many retirees wish they had prioritized earlier. Consulting professionals can offer insights into creating effective budgets and anticipating future expenses. This couple seems to be discussing their financial plans, likely focusing on how to manage their resources effectively. A proactive approach in saving and investing can lead to a more comfortable and worry-free retirement. It’s never too late to seek expert advice for financial security.

Seeking professional guidance is a crucial step in ensuring a stable financial future during retirement. Prioritize expert advice to help navigate complex financial decisions and secure your peace of mind.

Healthcare Costs in Retirement: A Common Oversight

Many retirees find themselves surprised by the rising cost of healthcare. Prescription medications, doctor visits, and unforeseen medical emergencies can significantly strain their finances. While Medicare helps cover some expenses, it often doesn’t cover everything. Retirees commonly express regret for not allocating more funds to healthcare in their savings. Preparing for these inevitable expenses can help ensure a more comfortable and secure retirement. Proper planning is essential for peace of mind.

In retrospect, prioritizing healthcare savings can provide retirees with greater financial stability. By considering these costs early on, they can enjoy their retirement years without unnecessary financial stress.

Home Modifications for Safe Living

As retirees look to age in place, home safety becomes a crucial concern. Many wish they had budgeted more for modifications, like installing grab bars in bathrooms. These changes can prevent accidents and offer peace of mind. Safety modifications not only support independence but also enhance comfort in daily routines. Prioritizing funds for these essential improvements can make a significant difference in quality of life.

Planning for these modifications can significantly improve living conditions. Retirees often find that safety and comfort are priceless, making every investment worthwhile.

Adaptations for Aging in Place: A Wise Investment for Retirees

Navigating the challenges of mobility can become a significant consideration for retirees, especially when stairs become a daunting daily hurdle. Many look back wishing they had allocated more funds for home adaptations such as stairlifts, which offer safety and ease. Investing in these modifications early can ensure comfort and independence at home. Retirees emphasize the peace of mind these adjustments bring. Planning for accessibility can transform daily living.

Thinking ahead about home modifications can greatly impact quality of life. Retirees highlight the importance of financial preparation for accessibility upgrades, ensuring comfort and independence in their later years.

Healthcare and Assisted Living Costs

Many retirees express that healthcare expenses often surpass their initial expectations. The reality of aging often involves unforeseen medical bills and the need for assisted living services. These costs can significantly impact a retiree’s budget, making it clear why some wish they had saved more. Planning ahead for potential medical needs and support services can alleviate stress and ensure a comfortable and secure retirement. Prioritizing health-related savings is essential for long-term peace of mind.

Planning for these financial needs can provide comfort and security. By saving more for healthcare, retirees can better manage unexpected expenses and improve their quality of life in later years.

Unexpected Healthcare Costs

Many retirees find themselves unprepared for the rising costs of healthcare. Medical expenses can quickly add up, especially when faced with unexpected illnesses or the need for long-term care. Assisted living and home health services often require significant financial resources that weren't anticipated. These expenses highlight the importance of having a solid financial plan to ensure comfort and security. Planning ahead can make a huge difference in retirement quality.

Careful financial planning can ease the burden of healthcare costs in retirement. By setting aside funds specifically for medical expenses, retirees can enjoy peace of mind and a more secure future.

Dental Care Costs Retirees Overlook

Many retirees find themselves surprised by the significant expenses associated with dental care in their later years. Regular check-ups, cleanings, and unexpected procedures can quickly add up, straining a fixed income. Many wish they had set aside more funds specifically for oral health to maintain their well-being and confidence. Investing in dental insurance or a dedicated savings account could alleviate stress. Planning ahead makes a significant difference in managing these costs.

While retirement brings freedom, it's essential to consider factors like dental expenses. Preparing financially for such needs ensures a more relaxed and enjoyable retirement.

Enjoying Life's Simple Pleasures in Retirement

Many retirees find joy in simple activities such as spending time outdoors, which can be a great way to stay active and healthy. However, some wish they had saved more money for hobbies and wellness activities that promote well-being. Regular outings, whether for yoga in the park or leisurely walks, enrich their lives significantly. These moments highlight the importance of prioritizing health and happiness during retirement. Planning financially for these experiences can enhance life after work.

Investing in personal happiness and well-being is crucial. Allocating funds for hobbies and active pursuits can lead to a more fulfilling and enjoyable retirement.

Staying Active and Enjoying Hobbies

Retirement offers a golden opportunity to pursue interests and hobbies that may have been sidelined during working years. Many retirees express a desire to have saved more for activities that keep them physically active, such as tennis. Engaging in sports not only promotes good health but also fosters social interaction and mental well-being. Planning for these expenses can enhance the quality of retirement life significantly. Prioritizing leisure activities can lead to a fulfilling retirement.

Investing in hobbies like sports can transform retirement into a period of joy and vitality, fostering lasting memories and friendships. Ensuring funds for these pursuits enriches the retirement experience.

Navigating Financial Decisions in Retirement

Managing finances in retirement can be challenging, especially as priorities shift. Many retirees find themselves grappling with unexpected expenses, highlighting the importance of careful financial planning. Whether it’s for healthcare, travel, or daily living costs, budgeting becomes crucial. The reliance on digital banking tools, like smartphones, can also be a new adjustment. Reflecting on these aspects, retirees emphasize the significance of saving more to enjoy a secure and fulfilling retirement.

In the end, planning ahead and adapting to new financial tools can help retirees meet their needs. The insights gained from experience can guide better financial decisions.

Dreaming of Beachside Bliss

Many retirees look forward to spending their golden years soaking up the sun on beautiful beaches. However, enjoying that idyllic lifestyle often requires careful financial planning. Unexpected expenses can arise, such as travel costs, accommodation, and leisure activities, which might not have been fully anticipated. Saving with these specific goals in mind ensures a worry-free experience. With foresight, retirees can savor their well-deserved relaxation without financial stress.

Ultimately, thoughtful planning and saving can make dream vacations during retirement a reality. Prioritizing these experiences can lead to lasting, joyful memories.

Classic Car Restoration Dreams Derailed by Costs

Many retirees find themselves dreaming of restoring classic cars as a hobby. However, the costs associated with these projects often catch them by surprise. From sourcing rare parts to hiring skilled labor, expenses can quickly escalate. This is compounded by the time and effort needed to bring these vehicles back to life. For many, the dream remains just out of reach without proper financial planning. Reflecting on this, they often wish they'd saved more.

Planning for hobbies in retirement is crucial. Passion projects like classic car restoration can be unexpectedly expensive. Financial foresight ensures dreams become reality, not regrets.

Gardening: A Hobby Worth Investing In for Retirement

Many retirees find joy and fulfillment in gardening, a hobby that provides not only beauty but also relaxation. It's a perfect way to spend leisurely days, nurturing plants and watching them grow. However, maintaining a garden can come with costs not always anticipated. From purchasing quality tools to buying seeds and plants, expenses add up. Retirees often wish they had allocated more funds for this rewarding pastime.

Planning for enjoyable activities, like gardening, can enhance the retirement experience. Prioritizing savings for hobbies ensures retirees can fully embrace these fulfilling pursuits without financial worry.

Healthcare Essentials in Retirement

As retirees reflect on their financial priorities, many emphasize the need to allocate more funds for healthcare essentials. Mobility aids and other necessary medical equipment often become vital, yet they can be surprisingly expensive. Planning for these costs can be crucial to maintaining independence and quality of life. Unexpected health issues might arise, requiring additional resources. Retirees often find that anticipating these expenses earlier would have eased their financial burden.

Preparing for healthcare expenses can significantly enhance retirement peace of mind. Planning ahead ensures you’re better equipped to handle unforeseen medical costs, making your retirement years more comfortable.

Investing in Wellness: A Key Priority for Retirees

Many retirees find that investing in wellness is crucial, as maintaining health and vitality becomes a top priority. Access to facilities like swimming pools allows for low-impact exercise, which is excellent for joint health and overall fitness. Regular exercise not only boosts physical well-being but also enhances mental clarity and emotional balance. Retirees often wish they had allocated more funds to such amenities, realizing their long-term benefits. Ensuring a healthy lifestyle becomes an indispensable part of enjoying retirement to the fullest.

Planning for such health-focused investments ensures a comfortable and fulfilling retirement. Prioritizing wellness can lead to richer, more vibrant post-retirement years.

Home Renovations in Retirement: A Costly Oversight

Many retirees find themselves dreaming of updating their homes, but renovations often come with unexpected costs. Kitchens, like the one shown, can be particularly pricey. Cabinets, countertops, and appliances add up, often exceeding initial budgets. Retirees wish they had saved more to comfortably handle these upgrades. With proper planning and budgeting, these projects can enhance both comfort and home value. Careful foresight can truly transform retirement living.

Reflecting on home improvements, retirees emphasize the importance of budgeting for renovations. Prioritizing savings for such projects can greatly impact overall satisfaction in retirement years.

Home Renovations and Outdoor Spaces for Retirement Bliss

Retirees often find joy in enhancing their living spaces, and many express regret over not budgeting for home improvements. Creating a welcoming outdoor area can transform a backyard into a peaceful retreat. Whether it's laying new patio stones or adding a garden, these projects enhance comfort and enjoyment. Planning for these upgrades can make retirement more fulfilling and your home more inviting for friends and family. Investing in quality materials pays off in the long term.

Consider setting aside funds specifically for home and garden projects during retirement. These enhancements not only increase property value but also improve your daily living experience, offering relaxation and happiness.

Managing Unexpected Bills and Budgeting Wisely

As retirees settle into their golden years, the task of managing finances becomes crucial. Many find themselves reviewing bills with more scrutiny than ever before. While retirement is meant to be a time of relaxation, unanticipated expenses can disrupt peace of mind. Bills related to healthcare, home maintenance, and other essentials often require more savings than anticipated. Planning ahead can ease these financial concerns, offering retirees a more secure future.

Reassessing financial priorities and preparing for unexpected costs can significantly enhance retirement satisfaction. Thoughtful planning ensures peace of mind and allows retirees to fully enjoy their well-earned leisure time.

Embracing Outdoor Adventures in Retirement

Many retirees find themselves longing for more outdoor adventures once they have the time. Whether it's rowing on a peaceful lake or hiking scenic trails, these activities offer both relaxation and excitement. They provide a perfect way to connect with nature and enjoy life's simple pleasures. However, such experiences often require proper planning and budgeting. Investing in these adventures can lead to enriching and memorable retirement years.

Retirees often wish they had saved more for exploring nature's beauty. Planning for these experiences can enhance retirement, turning it into a time filled with joy and discovery.

Embracing Tranquility at a Dream Retirement Cabin

Many retirees express the desire to have saved more for a peaceful retreat in their later years. A cozy cabin surrounded by nature provides a perfect setting for relaxation and reflection. As retirees reminisce about the simplicity and charm of such a retreat, they often wish they had set aside more funds to achieve this dream. The serenity and joy found in these settings are truly priceless.

Planning for a tranquil retirement in a serene cabin can offer peace and happiness. Prioritizing savings for such dreams ensures a fulfilling and stress-free retirement.

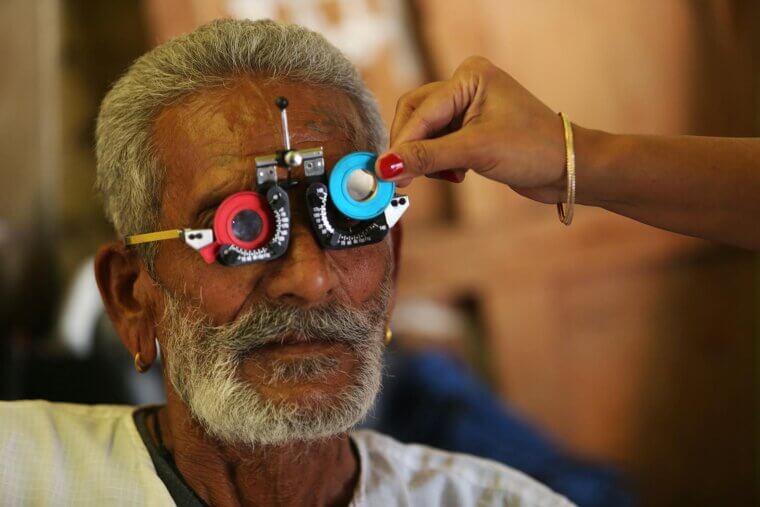

Eye Care Expenses in Retirement: Lessons Learned

Many retirees find themselves surprised by the escalating costs of eye care. Regular check-ups and prescription lenses are essential, yet often overlooked in financial planning. Vision changes with age, leading to a need for more frequent adjustments and specialized treatments. Additionally, unforeseen issues like cataracts or glaucoma can require costly interventions. Prioritizing savings for comprehensive eye care ensures better management of health and finances in retirement.

Planning for adequate healthcare, including eye care, is crucial in retirement. Allocating funds thoughtfully helps manage unexpected medical costs, providing peace of mind and maintaining quality of life.

Health Monitoring and Expenses

Many retirees find that health-related costs are more significant than anticipated. Regular check-ups, medications, and unexpected medical expenses can add up quickly. It's crucial to budget for preventative care and medical equipment. Planning for these costs can alleviate stress and help maintain a comfortable lifestyle. The importance of health monitoring becomes evident, emphasizing the need to prioritize savings for healthcare during retirement. Proper planning can make a substantial difference.

Prioritizing health means more than just regular check-ups; it involves careful financial planning. Ensure that you're financially prepared for the unexpected, securing peace of mind in retirement.

Companionship in Retirement: A Furry Friend

For many retirees, budgeting for pet care becomes an unexpected yet delightful necessity. Pets offer companionship and joy, making them indispensable for a fulfilling retirement. However, the costs of pet ownership, from food to veterinary care, can add up quickly. Retirees often wish they'd allocated more funds to ensure their furry friends receive the best care possible. Planning for these expenses can make retirement even more rewarding.

Ensuring a comfortable life for a beloved pet can enhance retirement significantly. Prioritizing savings for pet-related expenses ensures continued happiness and companionship in later years.

Adventure and Exploration in Retirement

For many retirees, the desire to explore the great outdoors grows stronger with age. The freedom to travel and experience new adventures is a cherished goal. However, the costs associated with travel, gear, and accommodations can add up quickly. Many retirees wish they had set aside more funds to fully embrace these enriching experiences. Planning ahead can turn these dreams into reality and make retirement more fulfilling.

Embrace the chance to explore and create memories during retirement. Proper financial planning can help make these adventures possible, allowing retirees to enjoy life to the fullest.

Surfing into Retirement: Embrace Adventure

Many retirees cherish the opportunity to explore new hobbies and adventures they never had time for during their working years. Engaging in activities like surfing can offer both excitement and a sense of youthful energy. The thrill of catching a wave or learning a new skill can be exhilarating and fulfilling. However, these experiences often come with expenses. Proper planning can ensure retirees have the resources to pursue these passions.

Embracing new adventures can be a fulfilling part of retirement. Prioritizing savings for hobbies like surfing allows retirees to fully enjoy their newfound freedom and excitement.

Embracing Outdoor Adventures

Many retirees find that they yearn for more time spent outdoors, basking in nature’s beauty. Whether it’s cycling through scenic trails or enjoying a peaceful afternoon picnic, these experiences can enhance the joy of retirement. Investing in quality outdoor gear is often overlooked but can significantly improve these activities. Creating lasting memories in beautiful settings becomes a cherished part of life’s golden years. Planning for these adventures can truly enrich retirement.

Ensuring funds for outdoor pursuits can elevate retirement experiences, providing endless enjoyment and fulfillment. Prioritizing such activities enhances well-being and creates unforgettable memories.

The Joy of Fishing

For retirees, leisure activities like fishing become cherished pastimes. Many wish they had saved more for these experiences, allowing them to enjoy life without financial stress. Fishing, in particular, offers a serene escape, connecting individuals with nature and providing relaxation. Equipment costs, travel to ideal fishing spots, and related expenses can add up, highlighting the importance of financial preparation. Planning ahead ensures these moments are truly rewarding.

Reflecting on the importance of funding hobbies can inspire future retirees to prioritize saving for personal passions. Ensuring financial readiness allows for fulfilling experiences.

Managing Unexpected Expenses

Retirement brings its own set of financial challenges, often catching retirees off guard. Many find themselves wishing they had saved more for unexpected expenses. Healthcare costs, home repairs, and sudden emergencies can strain budgets. Careful planning and saving can alleviate these financial stresses. Reflecting on these priorities can help future retirees prepare more effectively. Planning for the unexpected is crucial for financial peace of mind.

Prioritizing savings for unforeseen costs can make retirement smoother. Learning from those who've experienced these challenges can guide better financial decisions. Prepare now for a more secure retirement.

Prioritizing Joyful Moments

Many retirees express a desire to have saved more for leisure and enjoyment during their golden years. Engaging in activities like dancing lessons can bring immense joy and strengthen bonds. Financial preparation for these experiences often goes overlooked in favor of practical necessities. Yet, having the flexibility to invest in personal happiness can significantly enhance life satisfaction. Creating cherished memories becomes an invaluable asset. Retirees emphasize the importance of budgeting for joyful experiences.

As retirees reflect, they emphasize the importance of setting aside funds for leisure activities. Prioritizing personal joy can make retirement truly fulfilling. Financial planning should encompass both necessities and happiness.

Exploring New Cities

Many retirees express regret about not saving enough for travel. Exploring new cities can be a fulfilling way to spend retirement, offering both adventure and relaxation. The allure of cityscapes, cultural experiences, and trying local cuisines can be incredibly rewarding. However, these experiences often come with a price tag that many wish they had better prepared for. Proper financial planning can ensure these dreams become a reality.

Consider setting aside funds specifically for travel to enjoy these special experiences. Prioritizing travel in your retirement plans can lead to unforgettable adventures and cherished memories.